Manama, Kingdom of Bahrain – 14th December 2022 – The Central Bank of Bahrain’s (CBB) Board of Directors held its fourth meeting for the year 2022, chaired by Mr. Hassan Khalifa Al Jalahma on Wednesday, 14th December 2022. The Chairman commenced the meeting by congratulating His Majesty King Hamad bin Isa Al Khalifa and His Royal Highness Prince Salman bin Hamad Al Khalifa, Crown Prince and Prime Minister on the occasion of National Day.

The Board reviewed the topics on the agenda covering the performance report and developments in the financial sector for the fourth quarter of 2022 and the CBB’s financial performance report as of end of November 2022. The Board also reviewed the progress with regards to the Financial Services Sector Development Strategy, and the CBB’s estimated budget and investment policy of the bank for the year 2023.

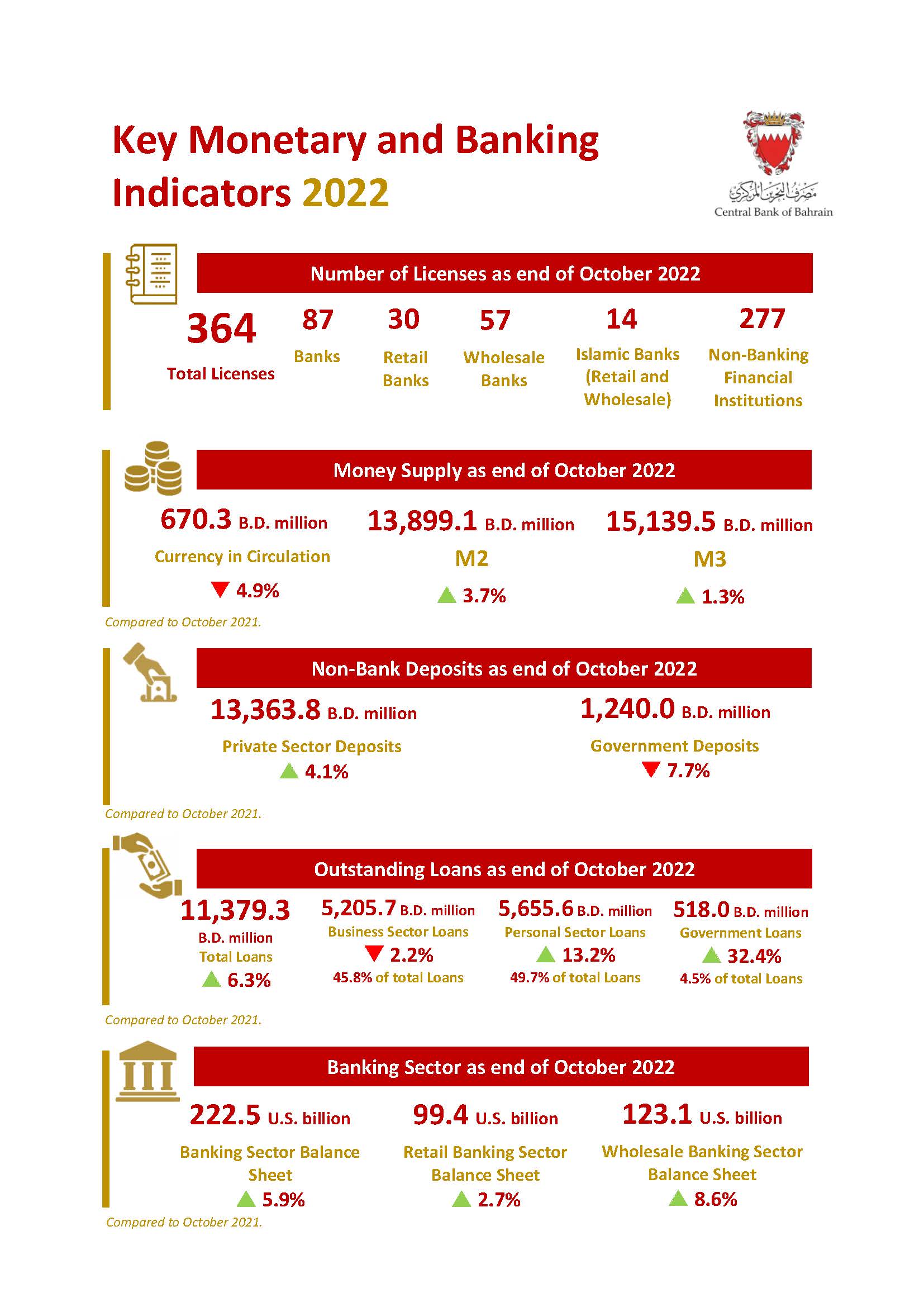

The Board also reviewed key monetary and banking indicators for the year including the money supply that increased to BD 15.1 billion at the end of October 2022, an increase of 1.3% compared to the end of October 2021. As for retail banks, total private deposits increased to BD13.4 billion at the end of October 2022, an increase of 4.1% compared to the end of October 2021. The outstanding balance of total loans and credit facilities extended to resident economic sectors increased to BD11.4 billion at the end of October 2022, an increase of 6.3% compared to the end of October 2021, with the Business Sector accounting for 45.7% and the Personal Sector at 49.7% of total loans and credit facilities. The balance sheet of the banking system (retail banks and wholesale sector banks) increased to $222.5 billion at the end of October 2022, an increase of 5.9% compared to the end of October 2021.

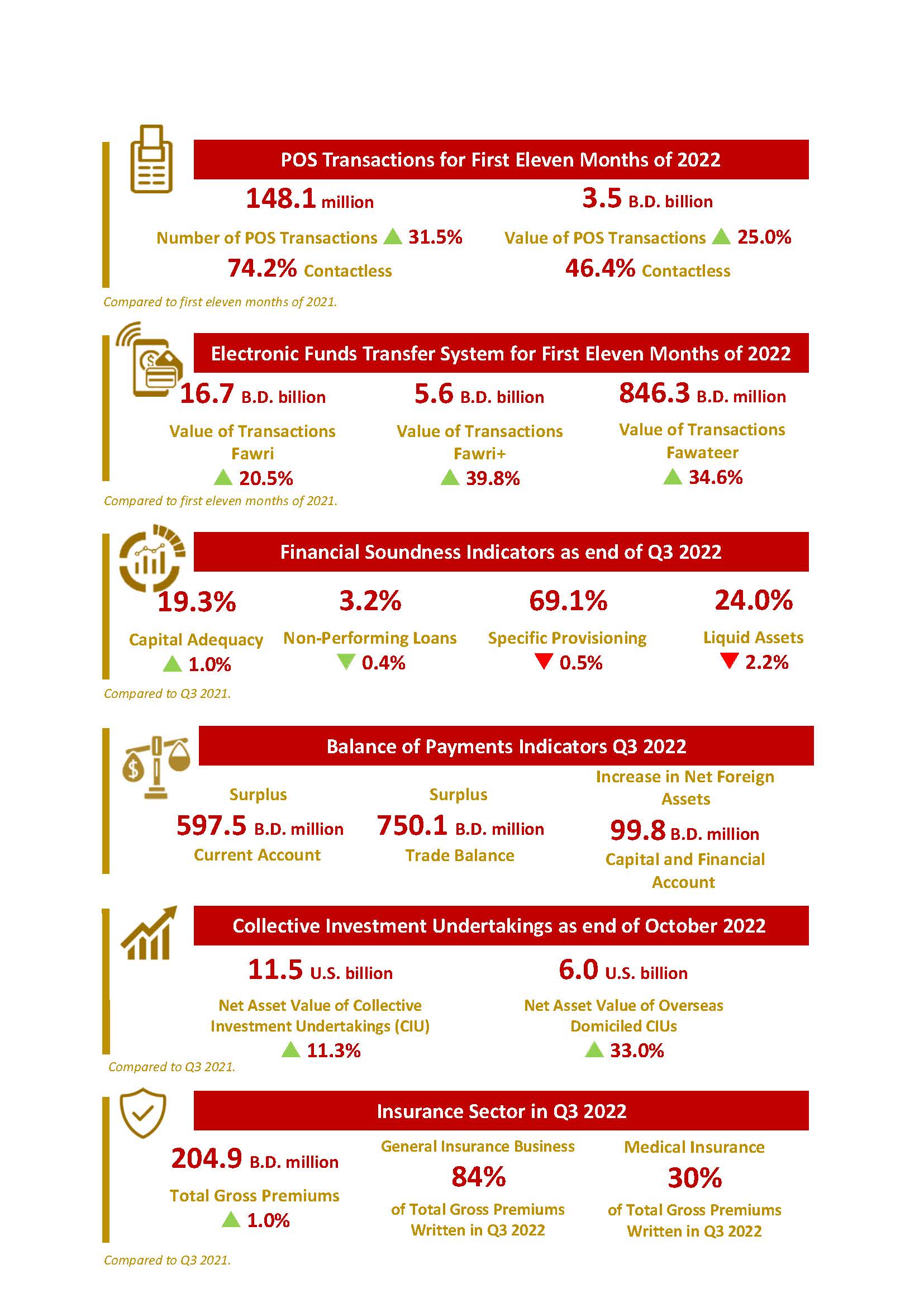

Point of Sales (POS) data indicated an increase in the number of transactions during the eleven months of 2022 (January – November 2022), totalling 148.1 million transactions (74.2% of which were contactless), an increase of 31.5% compared to the same period in 2021. The total value of POS transactions in Bahrain during the eleven months of 2022 (January – November 2022) totalled BD 3.5 billion (46.4% of which were contactless), an increase of 25.0% compared to the same period in 2021.

The banking sector maintained a high level of capital adequacy and liquidity, as the capital adequacy ratio of the banking sector reached 19.3% in Q3 2022 compared with 18.3% in the Q3 2021. The capital adequacy ratio for the various banking sectors is 20.8% for conventional retail banks, 18.1% for conventional wholesale banks, 21.0% for Islamic retail banks, and 15.4% for Islamic wholesale banks.

The total number of registered Collective Investment Undertakings (CIUs) as of the end of October 2022 stood at 1734 CIUs, of which 194 new CIUs were registered during the first ten months of 2022, an increase of 98% compared to the same period in 2021. The net asset value (NAV) of the CIUs increased from US$ 10.338 billion in Q3 2021 to US$ 11.499 billion in Q3 2022, reflecting an increase of 11.23%. Moreover, the NAV of overseas domiciled CIUs increased from US$ 4.533 billion in Q3 2021 to US$ 6.029 billion in Q3 2022, an increase of 33%.

As for the insurance industry, gross premiums amounted to BD 204.94 million in Q3 2022 compared to BD 203.30 million in the same period of 2021, reflecting a growth rate of around 1%, with general insurance business (including Medical insurance business) contributing to 84% of the gross premiums written for the same period of 2022. It is worth mentioning that Medical insurance is the largest in terms of total gross premiums which represented around 30% of the total gross premiums written in the third quarter of 2022.

The Board was also briefed on Standard & Poor’s credit rating for the Kingdom of Bahrain of B+ with positive outlook, reflecting the economic and financial developments witnessed by the Kingdom and the measures taken to implement the fiscal balance plan.

The Board expressed its satisfaction with the positive developments witnessed by the financial sector during the year, which reflect the policies and measures taken by the government to face the repercussions of COVID-19 and the return of economic activity to pre-pandemic levels. The Board also praised the constructive cooperation of the financial sector with the initiatives and policies taken by the CBB in order to achieve financial stability. The Board supports further cooperation with the sector to enhance the level financial services and maximizing the use of digital products by all economic sectors.