Manama, Kingdom of Bahrain – 26 June 2022 – The Central Bank of Bahrain’s (CBB) Board of Directors held its second meeting for the year 2022, chaired by Mr. Hassan Khalifa Al-Jalahma on Sunday, 26 June 2022.

The Board reviewed the topics on the agenda in addition to the CBB’s performance report and developments in the financial sector for the second quarter of 2022 and the CBB’s financial performance report as of end of May 2022. The Board also reviewed the work in progress with regards to the Financial Services Sector Development Strategy (2022-2026).

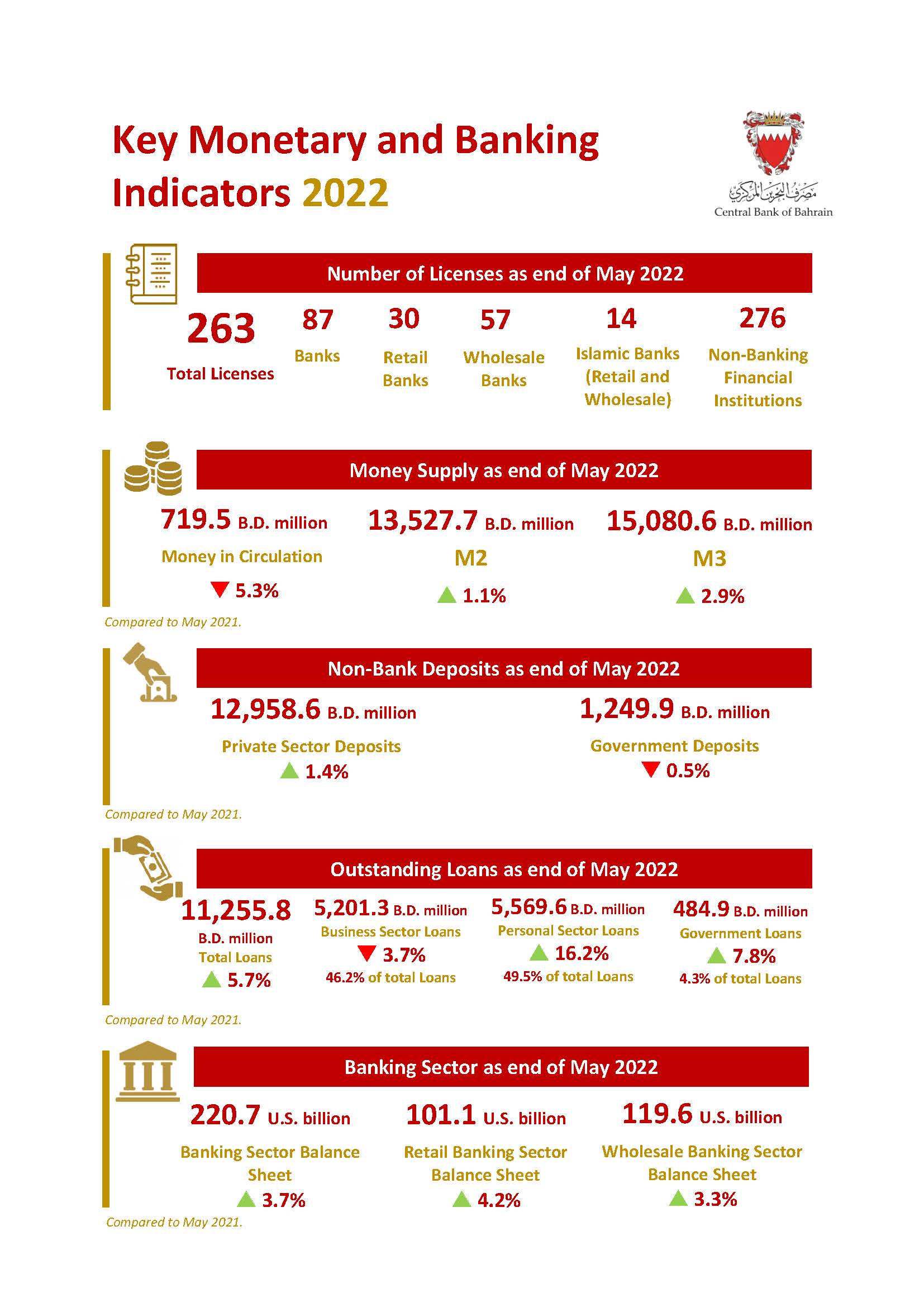

During the meeting, the board also reviewed key monetary and banking developments, as the data showed stable liquidity whereby money supply in its broad sense, M3 totaled BD 15.1 billion at the end of May 2022, an increase of 2.9% compared to the end of May 2021. As for retail banks, total private deposits increased to around BD13.0 billion at the end of May 2022, an increase of 1.4% compared to the end of May 2021. The outstanding balance of total loans and credit facilities provided to resident economic sectors increased to BD11.3 billion at the end of May 2022, an increase of 5.7% compared to the end of May 2021, with the Business Sector accounting for 46.2% and the Personal Sector at 49.5% of total loans and credit facilities. The balance sheet of the banking system (retail banks and wholesale sector banks) increased to $220.7 billion at the end of May 2022, an increase of 3.7% compared to the end of May 2021.

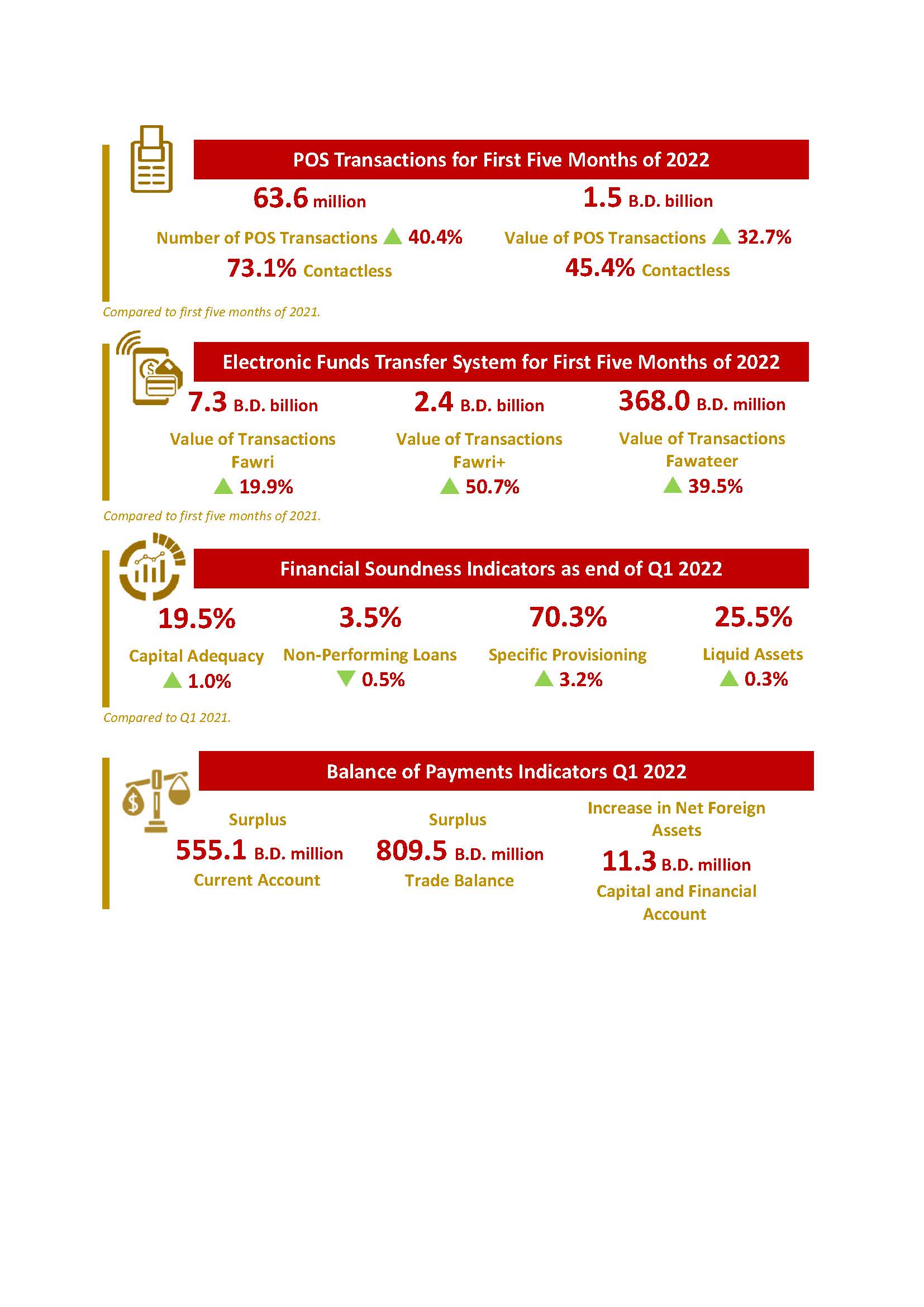

Point of Sale (POS) data indicated an increase in the number of transactions during the first five months of 2022 (January 2022 – May 2022), totaling 63.6 million transactions (73.1% of which were through contactless cards), an increase of 40.4% compared to the same period in 2021. The total value of POS transactions in Bahrain during the first five months of 2022 (January 2022 – May 2022) totaled BD 1.5 billion (45.4% of which were through contactless cards), an increase of 32.7% compared to the same period in 2021.

The banking sector maintained a high level of capital adequacy and liquidity, as the capital adequacy ratio of the banking sector amounted to 19.5% in the first quarter of 2022 compared with 18.5% in the first quarter of 2021. The capital adequacy ratio for the various banking sectors in the first quarter of 2022 was 21.3% for conventional retail banks, 17.8% for conventional wholesale banks, 21.3% for Islamic retail banks, and 16.4% for Islamic wholesale banks.

These indicators are consistent with the return of activity to all economic sectors in the Kingdom and demonstrate the financial sector’s stability and capacity to serve the national economy.

The Chairman and members of the Board of Directors expressed their thanks and appreciation to the Kingdom’s leadership for their support to the CBB and the efforts and measures taken to contain the repercussions of Covid-19, including the Economic Recovery Plan which contributed to the return of normal activities to all sectors of the economy.

The Board also expressed its appreciation for the efforts of the banking sector over the past year. The Board concluded its meeting by expressing its appreciation to CBB staff for their efforts during this year, which contributed to maintaining financial stability and developing the financial sector.