We use cookies to enhance your browsing experience, serve personalized ads or content, and analyze our traffic. By clicking "Accept All", you consent to our use of cookies.

Central Bank of Bahrain’s regulatory measures as part of precautionary efforts to contain COVID-19

Published on 18 March 2020

Media Center Coronavirus

Manama, Kingdom of Bahrain – 18 March 2020 – In light of the recent global outbreak of Coronavirus (COVID-19) and the preventative measures taken by the Government of the Kingdom of Bahrain to contain the virus, the Central Bank of Bahrain (CBB) issued a number of directives to preserve the health and safety of citizens, residents, and workers in the financial sector. In addition, a number of measures were issued to mitigate the effects of financial implications on financial services customers affected by the Coronavirus, as well as on financial institutions and merchants, and to assist them in mitigating these implications in addition to protecting the stability of the financial sector in the Kingdom of Bahrain.

The CBB urged providers of Point of Sale (POS) devices to communicate with merchants to sterilize such devices regularly and to require customers to directly enter and remove their cards from the POS devices. The CBB also urged all licensees to follow and implement sterilization instructions issued by the Ministry of Health and submit a report on this. The CBB also instructed licensees to communicate with the public by covering the measures taken to ensure the safety of their employees and customers in the press or through social media. The volume limit of contactless transactions on POS devices has been increased to BD50/- without the need to use a PIN code. The CBB also instructed its licensees to adhere to the requirements of continuation of operations and services.

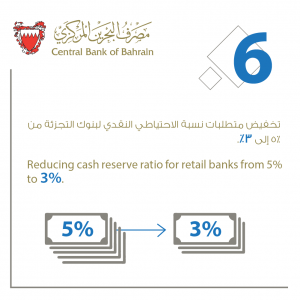

The CBB also issued a number of regulatory measures for a period of six months to contain any financial repercussions on customers of the banking sector, which will be reviewed by the CBB at the end of this period in consultation with the banking sector. These measures aim to provide more liquidity and flexibility to enable banks to continue providing financing to their customers.

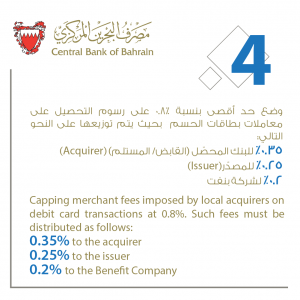

With regards to customers, these measures included requirements for retail banks, financing companies and microfinance institutions to postpone installments for any borrower or credit card holder affected by the economic repercussions of the Coronavirus without fees or interest on interest or increase in the percentage of profit / interest for a period of 6 months, unless the borrower agrees to pay within a shorter period. A cap of 0.8% has also been set on merchant fees imposed by local banks and finance companies on debit card transactions to reduce merchant and company costs.